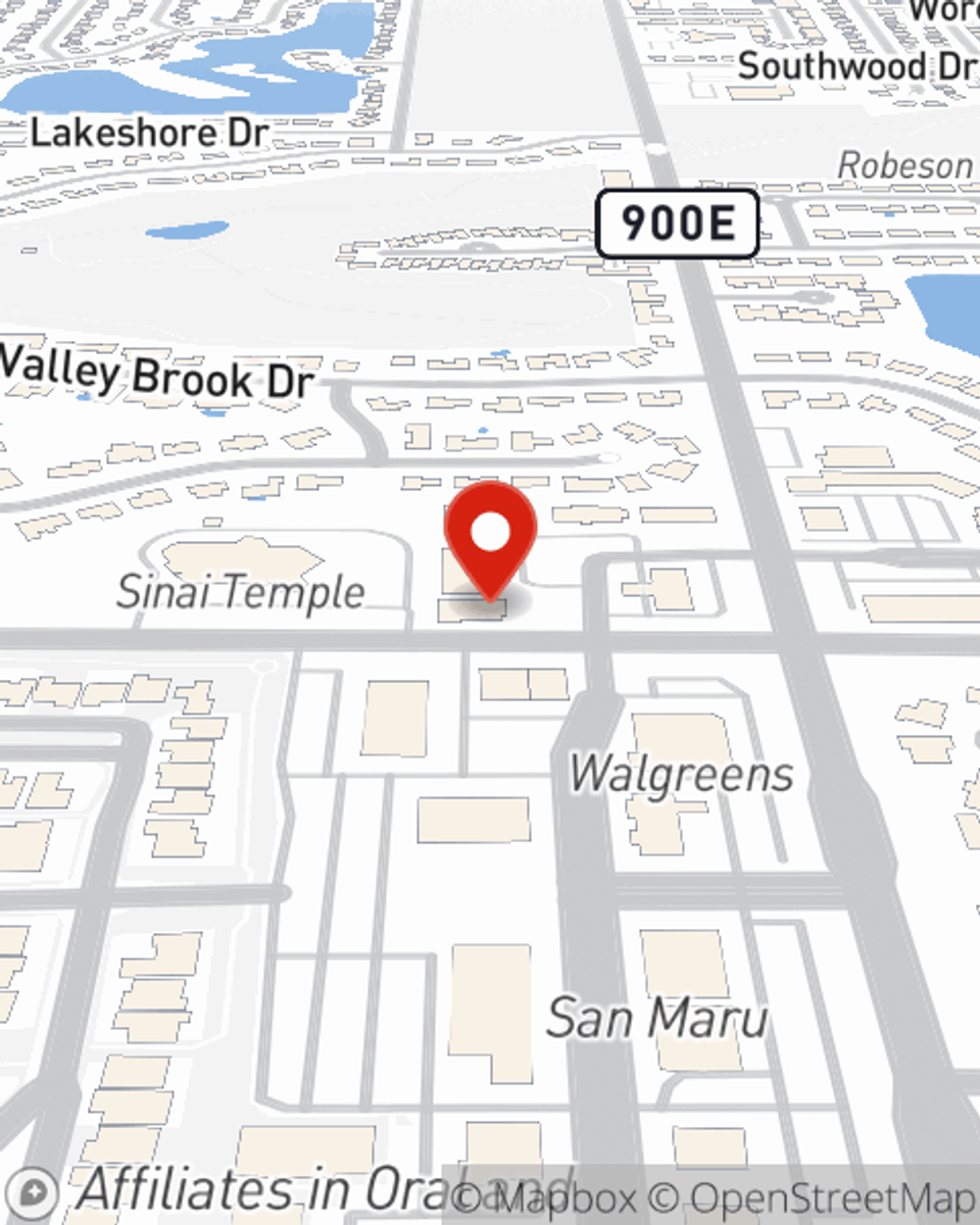

Business Insurance in and around Champaign

One of the top small business insurance companies in Champaign, and beyond.

No funny business here

- Champaign

- Urbana

- Indiana

- Missouri

- Mahomet

- Savoy

- Tolono

- White Heath

- Rantoul

- Sadorus

- Farmer City

- Seymour

- Bondville

- Mansfield

- Fisher

- Bellflower

- Saybrook

- Philo

- Saint Joseph

- Sidney

- Homer

- Thomasboro

- Villa Grove

- Pesotum

Help Prepare Your Business For The Unexpected.

You may be feeling like there is so much to do with running your small business and that you have to handle it all alone. State Farm agent Kurt Lenschow, a fellow business owner, is not unaware of the responsibility on your shoulders and is here to help you build a policy that's right for your needs.

One of the top small business insurance companies in Champaign, and beyond.

No funny business here

Surprisingly Great Insurance

Whether you are a dentist an optometrist, or you own an acting school, State Farm may cover you. After all, we've been helping small businesses grow since 1935! State Farm agent Kurt Lenschow can help you discover coverage that's right for you and your business. Your business policy can cover things such as loss of income and extra expense and computers.

It's time to visit State Farm agent Kurt Lenschow. You'll quickly observe why State Farm is one of the leaders in small business insurance.

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Kurt Lenschow

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.